Benefits of Golden Visa in Spain:

- A new type of visa which allows entering and staying in Spain for a period of 2 years, increasing the actual period of 90 days for non-residents.

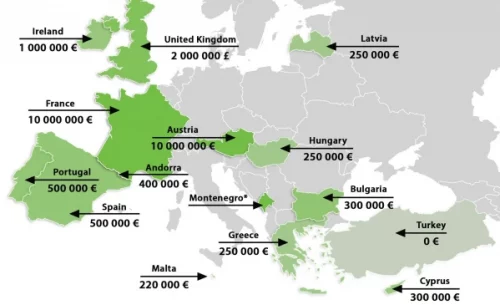

- Allows to circulate freely and without restrictions in the ‘Schengen area’ (Spain, France, Germany, Austria, Belgium, Denmark, Estonia, Finland, Greece, Hungary, Iceland, Italy, Latvia, Lithuania, Czech Republic, Liechtenstein, Luxemburg, Malta, Netherlands, Norway, Poland, Portugal, Slovenia, Slovakia, Sweden and Switzerland).

- A new type of residence permit, which can be requested at the end of the visa, and which is valid for two years renewable for a further period of two years.

- It does not entail a minimum period of residence in Spain of 183 days for its renovation (the beneficiary can keep his tax address out of Spain).

- Together with the investor, his family: spouse and children under 18 years of age or dependent adults due to health reasons, can request the visa.

Requirements

Investment amount

- In order to qualify for the Golden Visa you must invest from €500,000 in property.

Other requirements

- Not being in an irregular situation in Spanish territory.

- Being at least 18 years of age.

- Having no criminal record in Spain and in the countries where you have resided during the last five years, for crimes provided for in the Spanish legal system.

- Not being forbidden to enter Spain or being listed as liable to be refused entry in the territorial area of countries with which Spain has signed an agreement to that effect.

- Having sufficient financial resources for yourself and your family members during your period of residence in Spain.

- Having health insurance taken out with an insurance company authorized to operate in Spain.

- Not have any of the illnesses according to a 2005 regulation.

- Paying the visa application fee.

Length of Investment

Clearly the aim of the government is to stimulate the economy by encouraging foreigners to bring money into the country and to invest in it and in particular property and government stock. In return for certain investments, it may be possible to obtain a Visa to stay in Spain.

However, the aim remains that the government wants the investment in Spain and therefore the rules are written so that whilst you have your investment, and providing you comply with the requirements, you can

obtain a Visa. This is not a case of simply putting money into the country, getting the Visa and then taking your money back out again

Therefore the minimum investment has to stay invested in order to maintain the visa. You cannot therefore invest, get the visa and then withdraw the investment. You can, however, move your investment around (for example, sell one property and buy another one) providing that the investment is continual.

What does Investing in Property mean?

The requirement to invest a minimum of €500,000 in property is actually quite wide.

There is no need to buy one property for €500,000 and you can actually buy several properties. The important thing is that the total adds up to an investment of more than €500,0000. The properties can also be of different types – i.e. it doesn’t have to be residential. It is possible to invest in residential property, commercial property or even land. As part of a portfolio, it is also possible to have a mixture of different types of land.

The investment amount must be free of charges or mortgages (i.e. at least €500,000 must be free of charges but you are able to mortgage any amount above that figure.

How long does the Visa last for?

On the Golden Visa Scheme, the initial Visa is for a period of 2 years. It can be renewed for a further 5 years after that (providing that you still comply with the requirements).

After 5 years it will be possible to apply for a permanent Visa. This permanent Visa entitles you to do more than the initial Visa in that you are entitled to work in the country and are entitled to use the healthcare system. You also no longer need to keep the investment that you initially made.

After 10 years it will be possible to apply for Spanish Nationality should you wish to. This will mean that you are entitled to all the things that you would be entitled to as if you were Spanish. Clearly not everybody will want to go for this final step and may wish to keep their own Nationality but stay with the Spanish residency visa.

The Visa is reliant on the requirements for the Visa still being in place during the time that the Visa is valid. That is to say that, for example, if you invest in Spanish property to obtain a visa you must keep over €500,000 invested in the property during the duration of the visa. You cannot simply invest in Spain to get the Visa and then withdraw your investment once the Visa has been obtained.

Tax residence

Even if you obtain a residence Visa fro Spain you may not be tax resident there. The taxes that you pay when you buy a property in Spain will normally depend on whether you are tax resident there or not for tax purposes.

Tax residence is determined by a number of factors;

How long you spend in that country? Is it 183 days or more a year (not necessarily continuously). If so you are likely to be tax resident there.

- Is your main home there? If it is then you are likely to be tax resident there.

- Is your immediate family (spouse and dependent children) based there? If so you are likely to be tax resident there.

- Is your main economic interest there? If so you are likely to be tax resident there.

If you do become tax resident in a country then you will normally stop paying taxes in your home country and start to pay taxes in the new country.

Sometimes you should declare something for tax purposes in one country and also in another. If Spain and your country have a Double Taxation Treaty that means that you don’t normally pay tax twice and can offset the tax paid in the other country against the tax that you would otherwise pay in your home country.

Golden Visa: 3 steps

1. Documentation

- To proof that you have invested €500,000 or more and to complete the application for the Spanish residence permit some documents are required. Make sure you have:

- A Property Registry filing (certificate) OR notarised deeds and proof that the deeds have been submitted to the Property Registry.

- A passport valid for at least one more year.

- Two photographs of yourself.

- Proof of financial solvency

- If your spouse applies: a marriage certificate.

- If your children apply: birth certificates.

- Proof of valid medical insurance in Spain.

- Proof you have no criminal records.

2. Application

- If the individual is outside Spain: The visa application can be submitted by the foreign national in person or by means of a representative with the due accreditation.

- If the individual is in Spain legally: In this case, it is not necessary to apply for a visa, but rather for a residence permit for investors and capital investors or for the acquisition of real estate from the Large Companies and Collectives Unit (UGE).

3. Foreigner identity card (NIE)

- Once a visa or autorization from UGE has been issued, there are certain formalities that must necessarily be carried out in Spain.

- Foreigners who are granted a visa to stay in Spain for a period exceeding six months must apply for a foreigner identity card at the corresponding Provincial Brigade of Immigration and Borders dependent on the Ministry of the Interior, within one month from the date of arrival.